As European countries implement their EUDI wallet strategies, a critical policy choice will determine whether they capture billions in economic value or leave it on the table.

The state must serve as the trust anchor for PID. But nations that stop there—choosing state-only wallet ecosystems—will forfeit the economic opportunity entirely.

The real value isn’t in digitizing government IDs. It’s in enabling the private sector to build on top of that trusted foundation.

The state-only trap

Many EU member states are pursuing state-only EUDI wallet ecosystems, managing Person Identification Data (PID) and public sector Electronic Attestations of Attributes (PUB EAAs) like driver’s licenses and educational diplomas. Private EAA issuers? Effectively not looked at.

This approach fundamentally misunderstands where the value lies:

- Limited daily use: Wallets only useful for occasional government interactions won’t leverage the economic opportunity

- No private sector participation: Organizations that could issue valuable EAAs have no path into the ecosystem

- Missed economic transformation: The hundreds of credentials citizens manage through physical cards remain undigitized

The state is the cornerstone of trust. But a cornerstone without a building is just a block of stone in the ground.

Nations choosing state-only wallets will watch the economic opportunity flow to jurisdictions that enable private sector participation.

The winning model: state anchor + private innovation

The solution isn’t to remove the state from EUDI wallets, it’s to recognize that the state and private sector serve fundamentally different roles.

- State (trust anchor): Issue and manage PID, provide the foundational identity layer that private ecosystems can rely on

- Private sector (value creation): Build EAA ecosystems on top of the trusted PID, digitizing credentials across industries

This model works because:

- The state provides what only the state can: authoritative person identification under strict governance

- The private sector provides what it does best: innovation, speed, and sector-specific solutions

- Open standards (OpenID4VP, OpenID4VCI, W3C Verifiable Credentials) enable seamless interoperability

Nations that enable this model will capture the economic opportunity. Nations that don’t will be left behind.

Private EAA opportunities across sectors

Insurance

- Policy credentials that can be instantly verified during claims or at service points

- Road assistance memberships (ANWB, AA, ADAC) verifiable at breakdown locations

- Claim-free years attestations portable between insurers

Healthcare

- Professional credentials (AGB codes, BIG registrations) for instant provider verification

- Insurance coverage attestations for seamless hospital admission

- Vaccination records verifiable without exposing full medical history

Energy and utilities

- Contractor credentials for secure site access at grid operators

- Resident verification for connection processes

- Professional certifications for safety-critical work

Access and membership

- Building access credentials replacing physical keycards

- Gym and fitness memberships with instant verification

- Event tickets and venue access eliminating fraud

- Professional association memberships instantly verifiable

The economic case for private sector participation

These opportunities only materialize when private EAA issuers can participate. A high-compliance state ecosystem is simply not designed for issuing gym memberships, road assistance cards, or insurance credentials—nor should it be. State ecosystems come with state-level requirements:

Today, a DigiD integration requires an audit costing tens of thousands of euros and a time-to-market measured in months.

If every EAA issuer must go through that same process, the ecosystem will never scale beyond a handful of government use cases. The state should not be the bottleneck for private sector innovation. The only way to unlock this value at scale is through private ecosystems with proportionate compliance requirements, where a gym chain or insurer can start issuing verifiable credentials without navigating a government procurement process.

1. Reduced fraud and improved data quality

Cryptographically signed credentials eliminate forgery. When presented from a wallet, verifiers can instantly confirm:

- The credential was issued by the claimed organization

- It hasn’t been tampered with and is still valid

- It belongs to the person presenting it

Impact: Insurance fraud alone costs billions annually. Verifiable credentials make fraudulent claims significantly harder.

2. Operational efficiency

Digital credential issuance, presentation, and verification can be largely automated. No more printing membership cards, mailing replacements, or manual document verification.

Impact: Organizations can reduce onboarding time from days to hours. Physical credential production costs disappear across millions of members.

3. Enhanced customer experience

Instant credential presentation creates seamless verification. A gym member proves their membership in seconds. A patient confirms insurance coverage immediately at admission.

Impact: Higher conversion rates, reduced abandonment, and premium service opportunities.

Quantifying the opportunity

Netherlands example (17.5 million population):

- If digital workplace credentials save 15 minutes monthly for 4.4 million workers, that’s 1.1 million hours monthly of productivity gained

- If verifiable credentials reduce insurance fraud by just 5% in a €60 billion market, that’s €3 billion annually

- Digital membership credentials reducing costs by €2 per member across 20 million memberships saves €40 million annually

Advanced wallet features that drive adoption

Private ecosystems create demand for features beyond minimum state requirements. Government wallets optimize for compliance—private ecosystems push wallets to become genuinely useful in daily life.

Biometric-bound credentials

For financial transactions and high-value disclosures, a simple device unlock isn’t enough. Private ecosystems—banks, insurers, payment providers—will demand biometric verification every time a credential is presented. This provides the assurance level financial institutions require without adding friction for lower-stakes interactions.

NFC passport reading

Wallets that can read the NFC chip in international passports—as Yivi already demonstrates—unlock global applicability. Because passports follow the ICAO standard worldwide, this makes the wallet useful for people outside the EU. A non-EU resident visiting Europe could bootstrap their identity from their own passport, gaining access to services without needing a European PID. State wallets focused solely on national PIDs miss this entirely.

Additional access protocols

Building access, parking garages, and gated facilities require protocols beyond standard online credential presentation—think BLE (Bluetooth Low Energy) or NFC-based proximity verification. These protocols allow a wallet to function as a physical access credential, replacing keycards and fobs. State wallets have no incentive to support these niche but high-frequency use cases. Private ecosystems do.

Zero-knowledge proofs for age verification

Proving you’re over 18 without leaving a digital trail is a textbook example of zero-knowledge proofs—and it’s currently outside the scope of EUDI wallets. Yet age verification is one of the most demanded use cases across retail, hospitality, and online services. Private ecosystems can implement ZKP-based age verification today, offering maximum privacy guarantees where state wallets offer none.

Selective disclosure

Sharing only the minimum necessary information for each interaction. A verifier asking for proof of residency doesn’t need your full address—just confirmation you live in a certain region. Private ecosystems with diverse use cases drive the demand for fine-grained disclosure controls that state wallets, designed for broad compliance, won’t prioritize.

The policy choice that determines everything

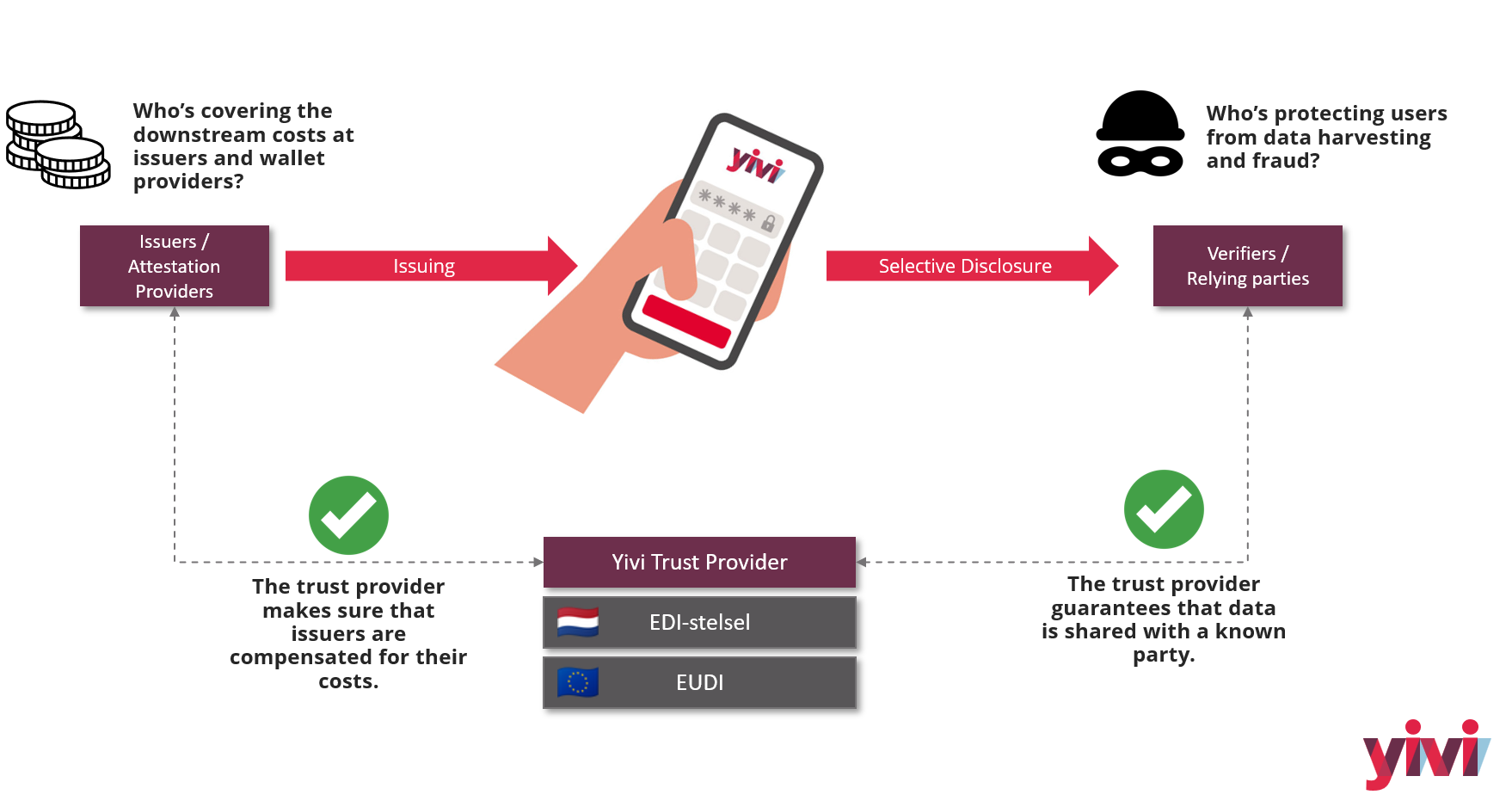

The economic opportunity described above is not automatic. It depends entirely on whether nations choose to enable private sector participation or lock it out. Crucially, this means trust schemes must be allowed to stack. The state scheme serves as the trust anchor—providing the foundational PID—while private trust schemes build on top of it to issue and verify sector-specific EAAs. A wallet holding a state-issued PID alongside privately issued credentials from different trust schemes is what makes the multi-ecosystem model work.

State-only approach:

- State manages PID and PUB EAAs

- Private EAA issuers at high compliance

- Economic opportunity: forfeited

State anchor + private ecosystem approach:

- State manages PID as trust anchor

- Private sector builds EAA ecosystems on top

- Economic opportunity: captured

Policymakers must:

- Recognize the state’s role as trust anchor, not monopolist

- Enable private EAA ecosystems to build on the PID foundation

- Establish clear rules for private participation without blocking it

- Certify multiple wallet providers to encourage innovation

Conclusion

The state is indispensable as trust anchor for PID. No private party can or should replace that role.

But the state alone cannot unlock the economic opportunity. Only private sector participation—building EAA ecosystems on top of the trusted PID foundation—can transform EUDI wallets from narrow government ID apps into platforms that deliver billions in economic value.

Nations face a choice:

- Enable private participation and capture the opportunity

- Maintain state-only ecosystems and watch the value flow elsewhere

The technical foundation exists. The economic case is clear. The only remaining question is whether policymakers will make the right choice.

Learn more

- Understand Yivi’s approach: docs.yivi.app

- Trust framework stacking: Read our blog on business and trust models

- Digital resilience and wallets: Digitaal Noodpakket — Bart Jacobs on ibestuur.nl

- For developers: yivi.app/for_developers

- Get in touch: yivi.app/contact